In the rapidly evolving landscape of mobile technology, the Go2Bank app stands out as a significant player, offering innovative features designed to enhance user experience and engagement. This comprehensive analysis delves into the app’s key components, including market trends and user adoption, SMS marketing strategies, and geolocation capabilities. By exploring the app’s user interface, security measures, and integration with other mobile technologies, we aim to provide a thorough understanding of how Go2Bank leverages these elements to drive effective mobile marketing. Additionally, we will review customer feedback and offer insights into future developments, offering actionable recommendations for optimizing mobile marketing efforts.

Explore this topic thoroughly with sizecredit.com

1. Overview of Go2Bank App

The Go2Bank app, developed by Green Dot Corporation, is a cutting-edge mobile banking solution designed to provide users with comprehensive financial management tools at their fingertips. Launched to meet the growing demand for digital banking, Go2Bank offers a range of features including a mobile checking account, savings tools, and budgeting insights. Users benefit from a user-friendly interface that simplifies financial transactions, such as direct deposits, bill payments, and money transfers.

The app also integrates with a range of financial services, allowing users to track their spending, set financial goals, and receive real-time notifications. With its emphasis on accessibility and convenience, Go2Bank is tailored for a diverse audience seeking a modern alternative to traditional banking. Its innovative approach is reflected in its seamless functionality, which enhances the user experience while maintaining robust security measures to protect

2. Market Trends and User Adoption

The Go2Bank app has entered the market at a time when mobile banking is experiencing unprecedented growth. With the rise of digital financial solutions, users are increasingly drawn to apps that offer convenience and comprehensive features. Market trends indicate a significant shift towards mobile-first banking solutions, driven by the need for accessible and flexible financial management tools. Go2Bank’s innovative approach aligns well with these trends, as it provides an array of features tailored to modern financial needs.

User adoption of Go2Bank has been robust, with the app attracting a diverse demographic seeking a streamlined banking experience. The app’s emphasis on user-friendly design and integration with other financial tools has contributed to its growing popularity. As digital banking continues to evolve, Go2Bank’s adaptability and responsiveness to user needs position it as a strong contender in the competitive mobile banking landscape.

3. SMS Marketing Strategies

SMS marketing is a crucial component of Go2Bank’s strategy to enhance user engagement and drive growth. By leveraging text messaging, Go2Bank effectively reaches users with timely and relevant information, capitalizing on the high open and response rates associated with SMS communication. The app employs SMS marketing to deliver personalized alerts, promotional offers, and important account updates directly to users’ mobile devices.

One of the key strategies involves sending transaction notifications and security alerts, which help users stay informed about their financial activity and enhance the app’s security measures. Promotional SMS messages are used to notify users about special offers, new features, and exclusive deals, encouraging them to explore and utilize additional app functionalities. This approach not only fosters user engagement but also drives app usage and customer loyalty.

Go2Bank also utilizes segmented SMS campaigns to target specific user groups based on their behavior and preferences. By analyzing user data, the app can tailor messages to address individual needs and interests, improving the effectiveness of its marketing efforts. Overall, SMS marketing plays a vital role in Go2Bank’s strategy, providing a direct and impactful channel for communication that complemen

4. Geolocation Features

Go2Bank incorporates geolocation features to enhance user experience and provide tailored services. By utilizing GPS technology, the app offers location-based functionalities that improve convenience and personalization. Users benefit from features such as finding nearby ATMs and branch locations, which simplifies cash withdrawals and in-person banking needs.

The geolocation capabilities also support targeted promotions and offers, delivering personalized deals based on the user’s current location. This approach helps users take advantage of relevant discounts and services in their vicinity, driving increased engagement with the app.

Additionally, Go2Bank uses geolocation to enhance security, monitoring account access and transactions to detect potentially fraudulent activities based on unusual location patterns. This proactive measure helps protect users’ financial information and provides an added layer of security. Overall, the integration of geolocation features aligns with Go2Bank’s commitment to delivering a personalized and secure banking experience.

5. User Experience and Interface

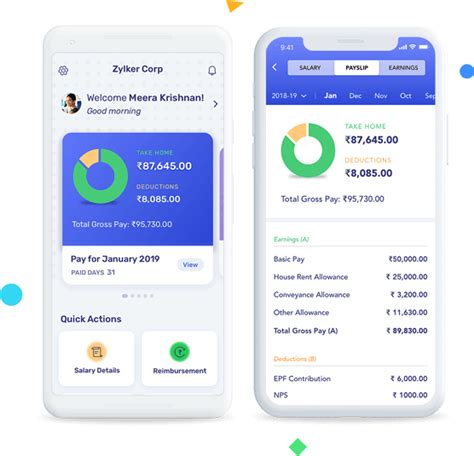

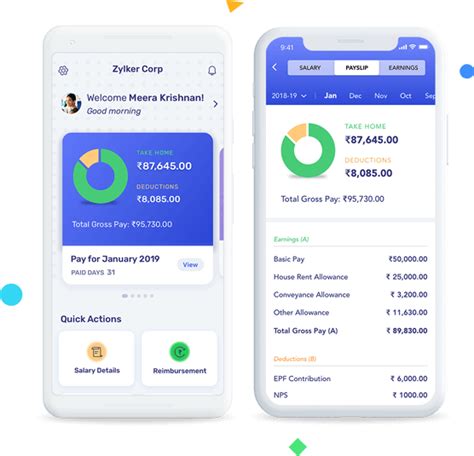

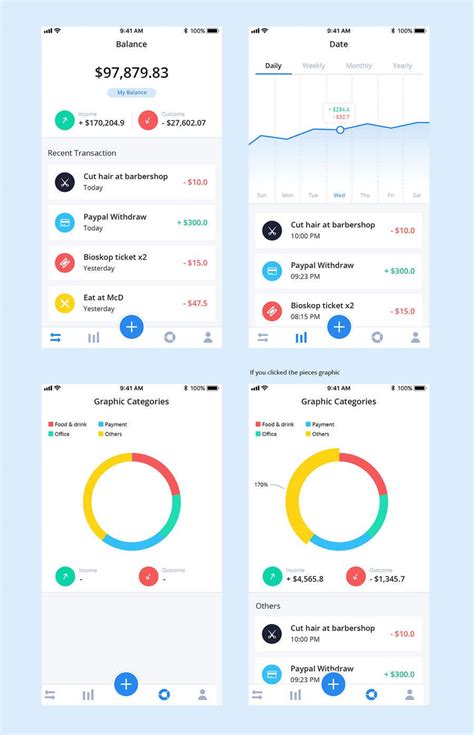

Go2Bank prioritizes a seamless user experience with a clean, intuitive interface designed to facilitate easy navigation and efficient financial management. The app’s interface features a streamlined design with clearly labeled sections, allowing users to quickly access key functions such as account balances, transaction history, and budgeting tools.

The user experience is enhanced by the app’s responsive design, which ensures that all features are accessible whether on a smartphone or tablet. The onboarding process is straightforward, guiding new users through account setup and initial features with minimal hassle.

Personalization is a key aspect of the user experience, with the app offering customizable notifications and alerts based on individual preferences. The design also incorporates user feedback to continually refine and improve the interface, ensuring it meets evolving user needs. Overall, Go2Bank’s focus on user-centric design and functionality provides a smooth, efficient, and engaging banking experience.

6. Security Measures

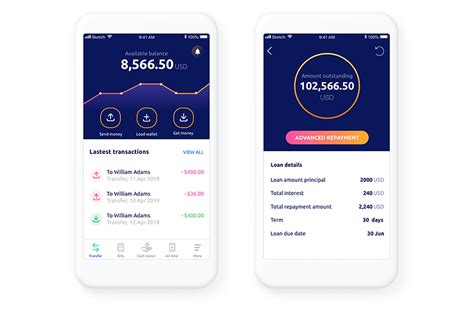

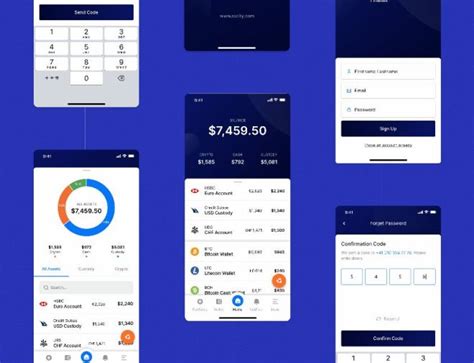

Go2Bank places a strong emphasis on security to protect users’ financial information and ensure a safe banking experience. The app employs advanced encryption protocols to secure data transmission and storage, safeguarding sensitive information from unauthorized access. Multi-factor authentication (MFA) adds an additional layer of security by requiring users to verify their identity through multiple steps, such as a text message or biometric scan, before accessing their accounts.

To further enhance security, Go2Bank incorporates real-time monitoring to detect and prevent fraudulent activities. The app analyzes transaction patterns and location data to identify suspicious behavior, triggering alerts and additional verification steps if necessary. Users are also encouraged to set up account alerts for transactions, which helps in promptly detecting any unauthorized activity.

Additionally, Go2Bank provides users with tools to manage their security settings, including the ability to lock or suspend their account in case of a lost or stolen device. These proactive measures demonstrate Go2Bank’s commitment to maintaining a secure environment for its users while continually adapting to emerging security threats.

7. Integration with Other Mobile Technologies

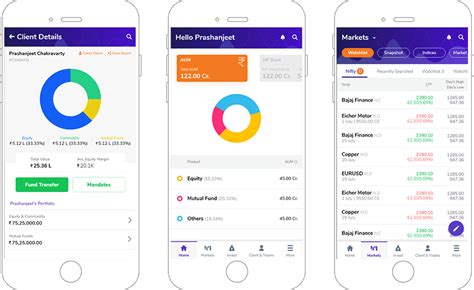

Go2Bank excels in integrating with various mobile technologies to enhance its functionality and user experience. The app’s compatibility with popular mobile wallets like Apple Pay and Google Pay allows users to seamlessly link their Go2Bank account for convenient payments and transactions. This integration facilitates faster checkouts and provides an additional layer of convenience for users who prefer digital wallets.

Furthermore, Go2Bank integrates with budgeting and financial planning apps, enabling users to synchronize their financial data across platforms. This integration helps users gain a holistic view of their financial health and manage their budgets more effectively.

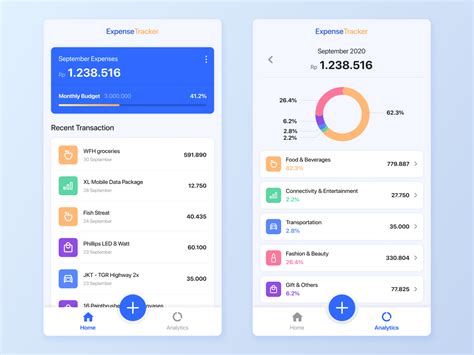

The app also supports API connections with other financial services and fintech solutions, expanding its ecosystem and providing users with access to a broader range of tools and services. For instance, integration with investment platforms and expense tracking apps enhances the overall financial management experience.

Additionally, Go2Bank’s compatibility with geolocation services enriches its functionality by offering location-based features such as finding nearby ATMs and branch locations. These integrations underscore Go2Bank’s commitment to leveraging mobile technologies to deliver a more connected and versatile banking experience.

8. Customer Feedback and Reviews

Customer feedback and reviews for the Go2Bank app highlight its strengths in convenience, user-friendly design, and robust functionality. Users frequently praise the app for its intuitive interface and ease of navigation, which simplifies managing finances on the go. The integration with mobile wallets and financial planning tools is also well-received, enhancing the app’s versatility and overall user experience.

However, some reviews note areas for improvement, including occasional issues with customer support responsiveness and occasional glitches with app updates. Despite these concerns, many users appreciate Go2Bank’s emphasis on security features and real-time alerts, which contribute to a sense of financial safety and control.

Overall, Go2Bank’s positive reviews underscore its effectiveness in meeting modern banking needs, while the constructive feedback provides valuable insights for ongoing enhancements. The app’s ability to address user concerns and continually evolve based on feedback is crucial for maintaining user satisfaction and staying competitive in the mobile banking market.

9. Future Outlook and Recommendations

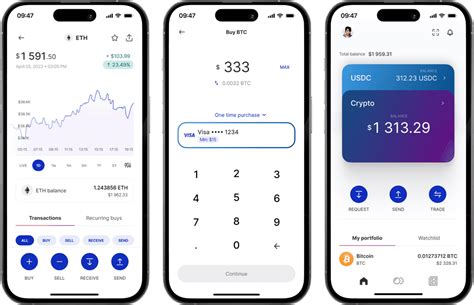

Looking ahead, Go2Bank is well-positioned to capitalize on the growing demand for digital banking solutions by continuing to innovate and adapt to emerging trends. The app’s focus on user-friendly design and advanced security features provides a strong foundation for future growth. To further enhance its market position, Go2Bank could consider expanding its integration with additional financial and fintech services, providing users with even more comprehensive financial management tools.

Incorporating advanced technologies such as artificial intelligence and machine learning could improve personalization and predictive analytics, offering users more tailored recommendations and insights. Enhancing customer support through chatbots and 24/7 service could address current feedback concerns and improve overall user satisfaction.

Additionally, expanding the app’s capabilities in areas like cryptocurrency integration and financial wellness tools could attract a broader audience and address evolving financial needs. By leveraging these opportunities and continuing to listen to user feedback, Go2Bank can maintain its competitive edge and drive sustained growth in the dynamic mobile banking landscape.

In conclusion, the Go2Bank app exemplifies innovation in mobile banking with its user-friendly interface, robust security features, and strategic use of SMS marketing and geolocation. As it evolves, ongoing integration with emerging technologies and responsive customer support will be crucial for maintaining its competitive edge and meeting users’ evolving needs.

sizecredit.com